Intapp Employee Compliance

Ensure employee compliance with firm and regulatory requirements

Intapp Employee Compliance makes it easier for your firm to monitor employees’ financial interests and outside activities, adhere to internal code of ethics policies, and track required documentation.

Help your professionals follow firm and regulatory requirements and make it simpler for your compliance team to review and manage everyone’s activities.

Protect your firm with Intapp Employee Compliance

Avoid costly fines, legal penalties, and reputational damage with centralized, configurable employee compliance risk management.

Simplify compliance

Give employees the tools they need to easily comply with firm policies.

Mitigate risk

Verify information with normalized data and flagged discrepancies.

Drive action

Automatically notify employees when actions are required and track progress.

Intapp Employee Compliance

Simplify the compliance process for your employees and risk team.

Configurable workflows and reminders

Support timely action and approvals with workflows and notifications.

An auditable system of record

Provide comprehensive histories for firm management and regulators.

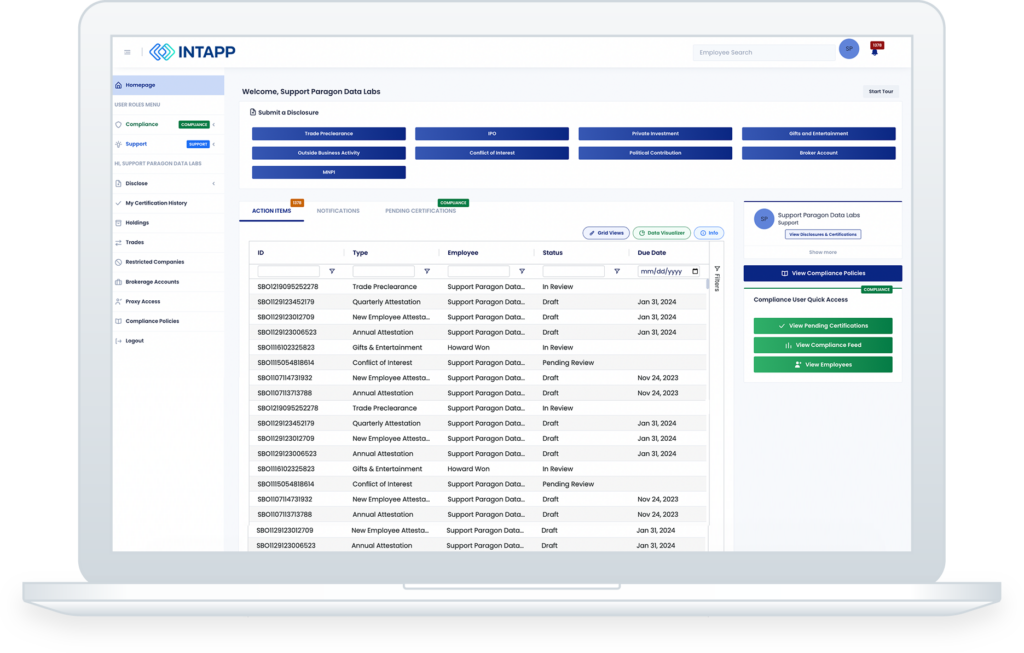

A single location for employee tasks

Create a hub for staff to track and receive approval for regulated activity.

Integrated compliance systems

Combine employee compliance with your existing HR and trading systems.

Personalized dashboards and reports

Provide role-based, centralized data views and dynamic reporting tools.

Automated trade pre-clearance

Streamline trade execution and approval using firm-determined criteria.

Frequently asked questions about Intapp Employee Compliance

-

Your firm has to ensure that your employees comply with all internal policies and attestation requirements, as well as meet regulatory requirements. If not, your firm could face costly fines, legal penalties, and reputational damage. Insufficient technology increases your risk of non-compliance and can cause your compliance team to waste resources tracking, researching, and confirming alignment to changing regulations and firm policy.

Intapp Employee Compliance is designed to help your employees easily adhere to firm policy and your compliance teams efficiently review, manage, and reduce employee compliance risk.

-

Intapp Employee Compliance can track regulated activities like investments, gifts, personal trading, political donations, cryptocurrency activity, and outside business activities, helping your firm accurately manage and demonstrate compliance. Additionally, your employees can complete their required forms, attestations, documents, and disclosures — all within the same cloud-based application.

-

You can configure Intapp Employee Compliance to meet your firm’s specific requirements and policies — including regulatory language, firm logo, restricted lists, workflows, and more. You can also connect the software with your firm’s existing systems, including HR management and trading platforms. And you can create customized audits by filtering data as broadly or narrowly as needed and sending personalized reports to the appropriate people or teams.

Schedule a demo of Intapp Employee Compliance

Speak with an expert

Fill out the form and someone will be in touch to schedule a demo.